GST is a single indirect tax that is applied to the supply of goods and services. Instead of paying multiple taxes at different stages of production and sales, GST ensures that there is only one tax from the manufacturer to the final consumer.

This helps remove the problem of “tax on tax” and makes the system fairer for both businesses and customers.

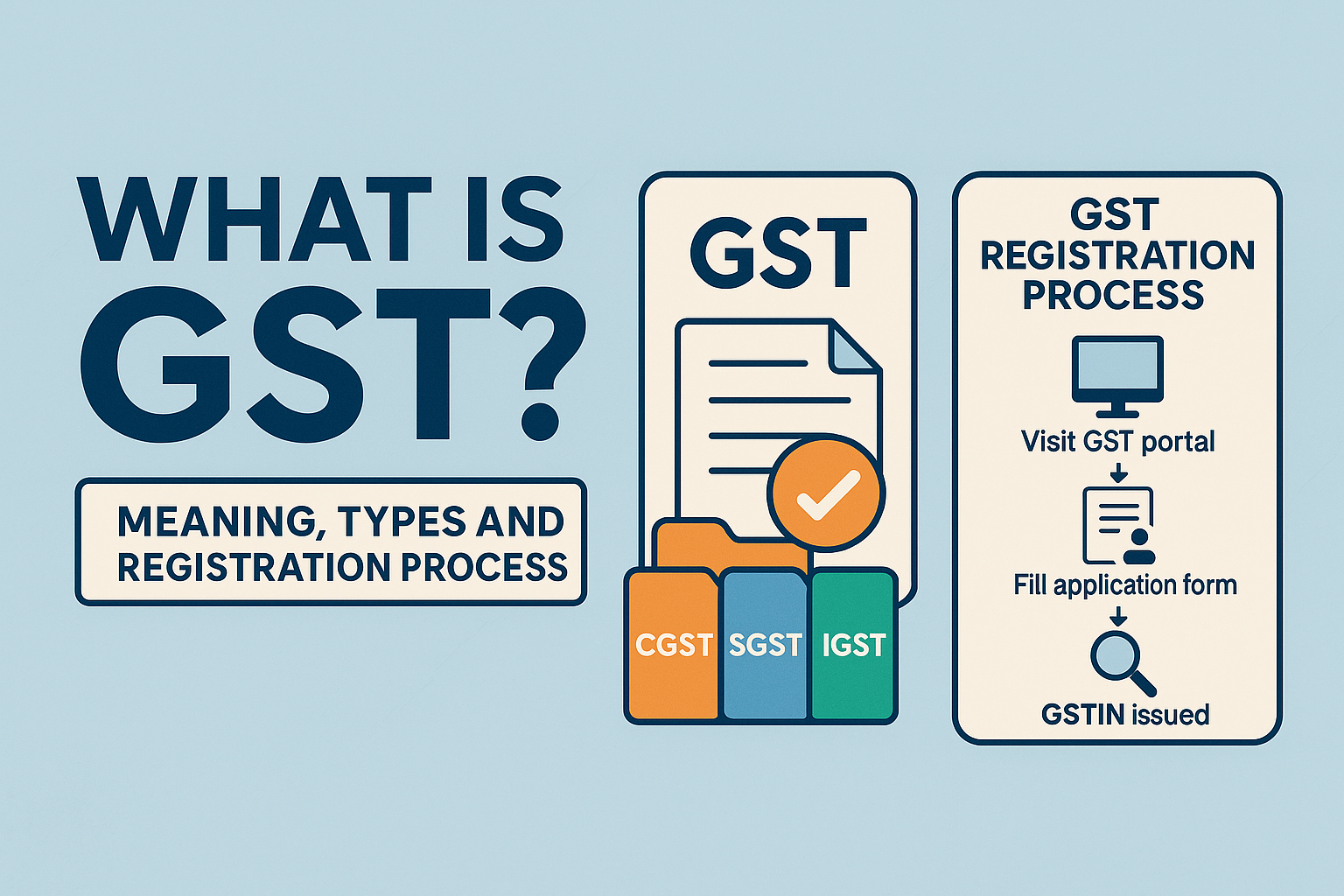

Types of GST

In India, GST is divided into four types:

- CGST (Central GST) – Collected by the central government on intra-state sales.

- SGST (State GST) – Collected by the state government on intra-state sales.

- IGST (Integrated GST) – Collected by the central government on inter-state sales (between states).

- UTGST (Union Territory GST) – Collected by union territories (like Delhi, Chandigarh, etc.) on intra-UT transactions.

Example:

- If you sell goods within Maharashtra, both CGST and SGST are applied.

- If you sell goods from Maharashtra to Karnataka, IGST is applied.

This division ensures that both central and state governments get their fair share of tax revenue.

GST Registration Process

Businesses that cross the threshold limit (₹20 lakh for services, ₹40 lakh for goods in most states) must register under GST.

Steps to Register for GST Online:

- Visit GST Portal → https://www.gst.gov.in/

- Click “Register Now” under the “Taxpayers” tab.

- Fill Part A:

- PAN of the business

- Mobile number & Email ID (for OTP verification)

- State & District

- Legal name of the business (as per PAN)

- Generate Temporary Reference Number (TRN)

- Fill Part B:

- Login using TRN

- Provide business details (name, constitution, district, etc.)

- Promoter/Owner details (PAN, Aadhaar, photograph)

- Authorized signatory details

- Place of business (address, rent agreement/ownership proof)

- Bank account details (account number, IFSC, cancelled cheque)

- Upload required documents (PAN, Aadhaar, photos, business proof, bank proof)

- Verification → Using DSC (Digital Signature), E-sign, or EVC.

- ARN Generation → Application Reference Number is issued.

- GSTIN Allotted → After successful verification, you get a 15-digit GSTIN (Goods & Services Tax Identification Number) and a GST Registration Certificate.

This number allows you to collect GST from customers and claim input tax credit.

Who Should Register?

- Businesses with an annual turnover above the threshold limit (Rs 40 lakh for goods and Rs 20 lakh for services in most states).

- E-commerce sellers.

- Businesses that were earlier registered under VAT, excise, or service tax.

- Non-resident taxable persons.

- Individuals or businesses making interstate sales.

Small businesses under the threshold can choose voluntary registration to avail input tax credit benefits.

What’s the Importance of GST?

GST has several benefits for the economy:

- Simplifies the tax structure.

- Reduces the chances of tax evasion.

- Brings uniformity across states.

- Makes it easier for businesses to expand nationwide.

- Ultimately, it benefits consumers with reduced costs.

GST has made India’s taxation system simpler, unified, and transparent. Whether you are a small shopkeeper or a large company, understanding GST is important to stay compliant and benefit from input tax credits. With its easy online registration process, GST has truly changed the way businesses operate in India.